Updated: 04.02.2026.

A sickness benefit can be received by a child’s parent (also a guardian or another person who, according to a decision of the Orphan’s Court, takes care of the child) who is an employee or self-employed, if they cannot attend work due to caring for a sick child and lose income from employment or self-employment, and if a doctor has issued a sick leave certificate B for caring for the sick child at home or in a hospital.

Attention!

If a sickness benefit is granted, the recipient can only receive the benefit if they do not earn income during the period of receiving it, including royalties.

The only exception is if a self-employed person has registered economic activity with the State Revenue Service, their monthly income does not reach the minimum wage, and the self-employed person makes state social insurance contributions on a general basis.

If, for any objective reason, the child’s parents are unable to care for the sick child, a doctor may issue a sick leave certificate B for caring for the sick child to a grandparent, adult sibling, or the child’s parent’s spouse. These persons, if employed (employees or self-employed), are also entitled to receive the sickness benefit.

A doctor issues a sick leave certificate B for caring for a sick child from the first day the child becomes ill.

The sickness benefit can be received when caring for a child up to 14 years of age (has not reached the age of 14).

If the child is diagnosed with a serious illness, the sickness benefit can be received when caring for a child up to 18 years of age. These are cases where:

- a medical council of the State Children’s Clinical University Hospital issues an opinion establishing the need for the parent’s continuous presence due to the serious illness, which requires prolonged treatment in a hospital;

- the child has been granted a child care allowance for a child with a disability.

The medical council’s opinion is received electronically by the State Social Insurance Agency (VSAA), and the parent does not need to submit this document when applying for the sickness benefit. Similarly, the VSAA has information on children who have been granted a child care allowance for a child with a disability.

Translation prepared with a machine translation tool

The sickness benefit must be requested within 6 months from the start date of Sick Leave Certificate B, which is the first day the child becomes ill.

To request the benefit, a specific application form addressed to the SSIA must be completed. The application can be submitted:

- on the Latvija.gov.lv portal;

- in person (when requesting the service in person, a personal identification document such as a passport or ID card must be presented);

- electronically (the application must be signed with a secure electronic signature containing a timestamp);

- by post.

Applications submitted in person can be submitted at any SSIA customer service center or at State and municipal unified customer service centers.

An e-application via the portal Latvija.gov.lv can only be submitted if the Sick Leave Certificate B has been registered electronically in the Unified Health Care Information System.

If an official electronic address account (e-address) is activated, the SSIA decision will be sent to the e-address, regardless of how the application was submitted.

If no e-address is activated:

- if an e-application was submitted via Latvija.gov.lv, the decision will be viewable on the portal;

- if the application was submitted in person at SSIA, electronically with a secure electronic signature, or by post, the decision can be received according to the method indicated in the application: via Latvija.gov.lv, in person, or by post.

The benefit will be transferred by SSIA, at the recipient’s choice, to a personal account in a Latvian credit institution or a postal payment system account.

Translation prepared with a machine translation tool

When determining the amount of the sickness benefit, the average insured earnings of the applicant are taken into account.

The average daily insured earnings are calculated as follows:

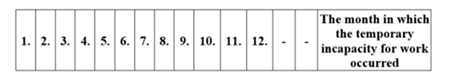

- For an employee, based on a 12-month period ending two months before the month in which the temporary incapacity for work begins (i.e., the first day of sick leave).

- For a self-employed person, the average insured earnings are calculated in accordance with the actually paid contributions for the last 12-month period ending one quarter (three months) before the quarter in which the temporary incapacity for work occurred.

The average daily insured earnings are calculated using the following formula:

Vd = (A1 + A2 + … + A12) ÷ D

Where:

- Vd – average daily insured earnings;

- A1, A2 … A12 – the amount of insured earnings for each month;

- D – the number of calendar days.

If, during part of the 12-month period used to calculate the average insured earnings, the person was:

- on childcare leave;

- on unpaid leave granted due to the need to care for a child;

- on paternity leave;

- on maternity leave;

- temporarily incapacitated for work;

the above-mentioned days are excluded from the total number of calendar days when calculating the average wage.

If no income was earned during the entire 12-month period due to the above-mentioned reasons, the average wage is calculated based on the preceding 12 calendar months before the leave or temporary incapacity periods, i.e. from income earned before those periods while working or while making mandatory contributions as a self-employed person.

If, during the 12-month period, there were months with no employment income because the person, was not in employee status, did not make mandatory contributions as a self-employed person, or was on unpaid leave, the average wage for those months is determined as 40% of the average insured earnings in the State.

The following payments are not included in the insured earnings sum - bonuses, premiums, benefits, and other types of remuneration paid by the employer during periods of temporary incapacity for work, maternity/childbirth leave, childcare leave, or unpaid leave granted for childcare purposes.

When calculating the average insured earnings for determining the amount of the benefit, severance pay and compensation for unused annual leave are also excluded.

The sickness benefit is granted in the amount of 80% of the applicant’s average insured earnings.

Translation prepared with a machine translation tool

A sickness benefit is paid to an employee or a self-employed person for the period during which the person is unable to work and loses income due to illness.

If a child under the age of 14 becomes ill, a doctor, from the first day of the child’s illness, issues the parent a certificate of incapacity for work (certificate B) with the reason “care of a sick child”, “care of a sick child in an inpatient facility”, or “care of a child with bone fractures”. On the basis of the certificate of incapacity for work, the SSIA grants and pays the sickness benefit for the following periods:

- from the 1st to the 14th day of the child’s illness, if the child is cared for at home;

- from the 1st to the 21st day of the child’s illness, if for part of the period the child is treated in an inpatient facility;

- from the 1st to the 30th day of illness, if the child is cared for due to an injury associated with a bone fracture.

Sickness Benefit for the Care of a Seriously Ill Child

1.If a child under the age of 18 becomes ill and has been diagnosed with a serious illness, and in addition to a certificate of incapacity for work (certificate B) a medical council has issued an opinion confirming the necessity of the parent’s continuous presence, the SSIA grants and pays the sickness benefit:

- in the case of continuous illness – for the period determined by the medical council, which may not exceed three months at a time and not longer than 26 weeks (half a year) in total, counted from the child’s first day of illness;

- if the child becomes ill intermittently – for no longer than three years within a five-year period.

If the treatment is very long-term and the child requires the parent’s continuous presence, two medical council opinions may be issued for one continuous illness case.

If a medical council opinion is not issued, the right to sickness benefit for the care of a sick child is determined under the general procedure, i.e. in the same manner as for the care of a child under the age of 14.

2. If a child under the age of 18 becomes ill and a care allowance for a child with a disability has been granted for that child, the SSIA grants and pays the sickness benefit:

- in the case of continuous illness – for no longer than 26 weeks (half a year), counted from the first day of illness;

- if the child becomes ill intermittently – for no longer than three years within a five-year period.

Accordingly, if the State Medical Commission for the Assessment of Health Condition and Working Ability has determined the need for special care, on the basis of which the child has been granted a disability care allowance, a medical council opinion is not required for granting the sickness benefit.

In both cases, the conditions for the payment of the sickness benefit apply regardless of whether the child is cared for throughout the entire illness period by one parent (one person) or by several persons in succession, and regardless of the reason indicated in the certificate of incapacity for work.

When paying the sickness benefit, personal income tax is withheld from the calculated amount.

When paying the sickness benefit, the SSIA applies the taxpayer’s non-taxable minimum, as well as personal income tax allowances for dependants and additional tax relief for persons with disabilities, politically repressed persons, and participants of the national resistance movement, if the person is entitled to such allowances.

The amount of the sickness benefit may be estimated using the SSIA sickness benefit calculator.

Translation prepared with a machine translation tool